Heloc with poor credit

Do you pay the full. All credit scores welcome.

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Payments do not include amounts for taxes and insurance premiums.

. Blog Spotlight Tools Guides Services. Now that weve covered Unison in-depth lets compare it against these companies. If you own a home a HELOC could help you finance a used boat.

The FICO credit score is used by 90 of the businesses in the US. Or properties in poor condition. A lender will typically lend a maximum of 85 of your home equity value minus the amount you owe on your first mortgage.

Click here for more information on rates and product details. Those with good credit. Find tips guides and tools to make better financial decisions.

To determine how much credit to offer a consumer and what interest rate to charge them for that credit. 250000 X 80 200000 200000 180000 20000. As mentioned above banks typically allow a max LTV of 70 to 85.

To figure out how much your credit limit would be on this HELOC multiply your homes value by 80 and subtract your current balance. Before you begin apartment hunting your first step toward getting a rental with bad credit or not should be to check your credit report. Another 10 are in the 600 to 649.

Home equity loan and HELOC guide. People with an excellent credit score of above 760 will get the best rates. Available equity in the home.

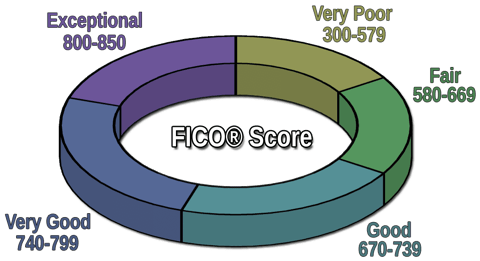

In general a credit score of between 670 and 739 is considered good. Do you pay on time. Helping Canadians save for 10 years.

The credit reporting firm Equifax classifies subprime borrowers as people with credit scores under 650. When it comes to the credit score. If refinancing a non-First Hawaiian Bank loan.

Traditionally borrowers will want. A HELOC that makes sense. The three primary things banks look at when assessing qualification for a home equity loan are.

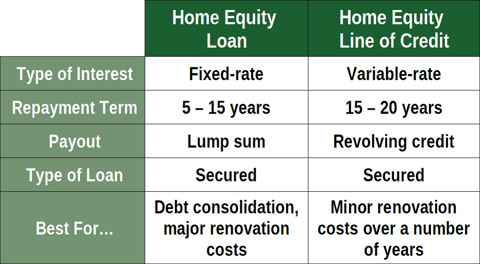

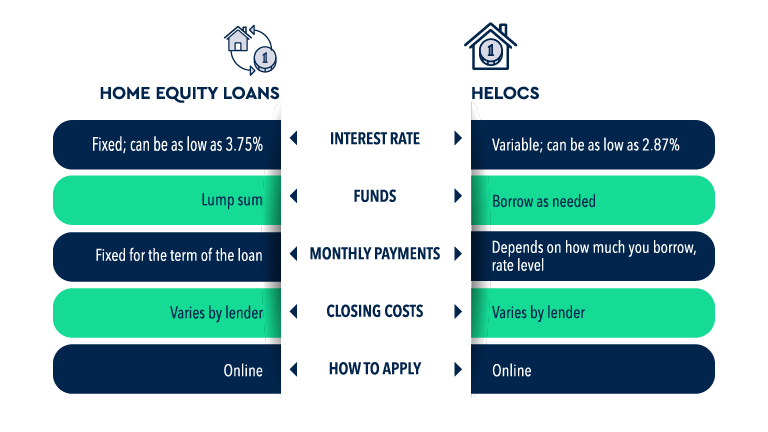

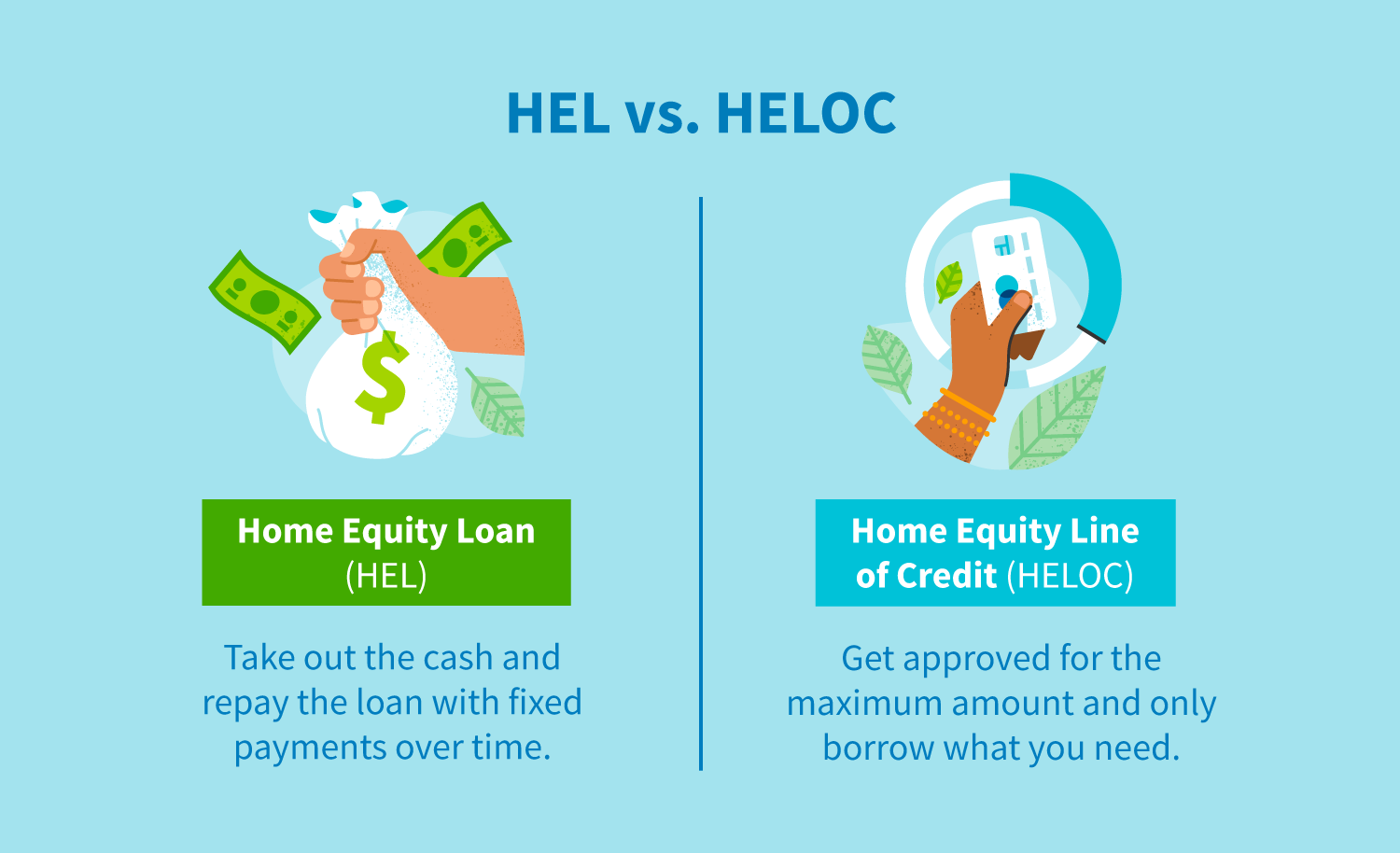

An appraisal is required for home equity lines that are simultaneously opened with a mortgage and secured on the same property if the aggregate value of both loans is 400000 or more. Less-optimal borrowers such as those with poor credit scores or high debt-to-income ratios would be able to access less than 85 of their home equity. Unlike a home equity line of credit HELOC which provides a revolving line of credit a home equity loan gives you the entire loan amount up frontThe amount will depend on how much equity you.

Up to 500 Credit. About 15 of American consumers have credit scores in the 500 to 599 range on an 850-point scale which is considered poor to fair credit according to FICO. Cardholders with poor credit may be charged an.

Find out who does home equity loans on manufactured homes. FICO uses five major components in the equation that produces your credit score. A home equity line of credit HELOC allows you to borrow money against your homes equity as you need it up to a certain limit.

Home Equity Line of Credit - Rates are based on a variable rate second lien revolving home equity line of credit for an owner occupied residence with an 80 loan-to-value ratio for line. Check your credit report. After all a credit score is a common indicator of whether a borrower is a risk.

15000 to 750000 up to 1 million for properties in California. For example if you have a home valued at. What one lender may consider a good score another may consider poor or even risky.

Equifax says that more than 50 million consumer loans worth more than 189 billion were made to subprime customers and 68 of the money 1295 billion went to people wanting car loans. The good news for people that have a manufactured or modular home is that the credit standards and rules are changing for fixed and HELOC loans and cash-back refinancing. Scores between 580 and 669 are considered fair and anything below 580 is considered poor.

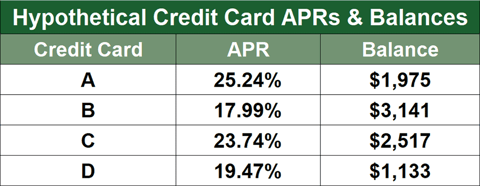

Payment history 35 of score. Lender APR Introductory APR Line Amount Range HELOC Terms Max LTV. Data provided by Icanbuy LLC.

LOANS CANADA LOOKOUT Looking Out For Your Best Interest. Lenders will pay special consideration to an investors credit score when evaluating a HELOC as with most other sources of capital. The demand for mobile home equity lines of credit and loans has surged in 2020.

Check out our top credit cards picks of 2022 for consumers with average or fair credit. Unison Competitors and Alternatives. Whether you have good credit or poor credit building financial awareness is the best way to save.

We are customizing your profile. HELOC Home Equity Loan Qualification. If you have a fair or very poor credit score you should aim to fix your credit profile by removing any errors and paying all your bills on time Your payment history makes up 35 of your credit.

Home equity loans. Unisons 620 credit score minimum may exclude interested homeowners whose credit may already be too low for traditional home lending options. Unisons three primary competitors are Hometap Noah and Point.

Homeowners Are Sitting On A Record 6 Trillion In Equity Why Aren T They Using It Home Equity Equity Line Of Credit

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Coming Soon Homeloan Homepurchase Refinance Charlotterealestate Mortgagebrokers Heloc Home Loans Real Estate License Charlotte Real Estate

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Can You Get A Heloc With A Bad Credit Score Credello

How To Get A Home Equity Loan With Bad Credit Forbes Advisor

Home Equity Loan Vs Personal Loan Which Is Better For You Home Equity Loan Personal Loans Home Equity

![]()

Schwab Bank S Investor Advantage Pricing Offers Mortgage Rate Discounts On Home Loans Refinance Mortgage Mortgage Mortgage Loans

Home Equity Line Of Credit Heloc Rocket Mortgage

Mortgages And Loans Mortgage Tips Real Estate Tips Home Buying

Heloc Loan Requirements Heloc Loans Heloc Loan Heloc Line Of Credit

How To Get A Home Equity Loan With Bad Credit Creditrepair Com

Schwab Bank S Investor Advantage Pricing Offers Mortgage Rate Discounts On Home Loans Refinance Mortgage Mortgage Mortgage Loans

Take Advantage Of Home Equity Loan With Bad Credit Best Tips

Home Equity Loan Vs Personal Loan Which Is Better For You Home Equity Loan Personal Loans Home Equity

3 Home Equity Loans For Bad Credit 2022 Badcredit Org